Farmland Market Update – Savills report

Savills has recent published its annual research publication covering all aspects of the Great Britain (GB) Farmland Market at a national level.

Economic change and uncertainty continue to have an impact on the farmland market in GB. Alongside the traditional core drivers of this market some new influences are on the horizon including regulatory change, a shift towards public money for public goods, enforcement of the polluter pays principle and an increased scrutiny on land value capture. All these will amplify the importance of nurturing natural capital, non-farm income streams, economic AgTech and innovation take up.

Key findings include:

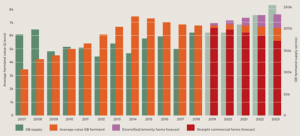

- Farmland values 2019 and beyond – a mixed forecast: Quality and diversity of the asset will underpin performance – see page 2 for more information

- The farmland market 2018: Farmers represent around 45% of all buyers with 85% buying to expand. Sales data shows the proportion of farmers selling has fallen each year since the EU Referendum in 2016. In 2018 farmers represented 39% of all sellers; the lowest figure recorded for at least 25 years

- Could a third of the UK land area change use by 2050? The next 30 years are likely to see some significant changes in land use across the UK that will no doubt impact on the tenure of farmland and its capital and rental values – we discuss in more detail on pages 4 and 5

- Comparative investment performance: rural property, notably let estates, farms and forestry, have been a comparable investment to alternative property assets and financial instruments over the past 20 years (see pages 6 and 7)

The report is available to read here

Agri-TechE

Agri-TechE